Mortgage credit rises thanks to more jumbo offerings

Ryan Danko | April 21, 2023 | Mortgages | 0 comments

After coming in at its tightest in over a decade, residential lending credit loosened up marginally in March, thanks to greater offerings of jumbo and conventional products, according to the Mortgage Bankers Association.

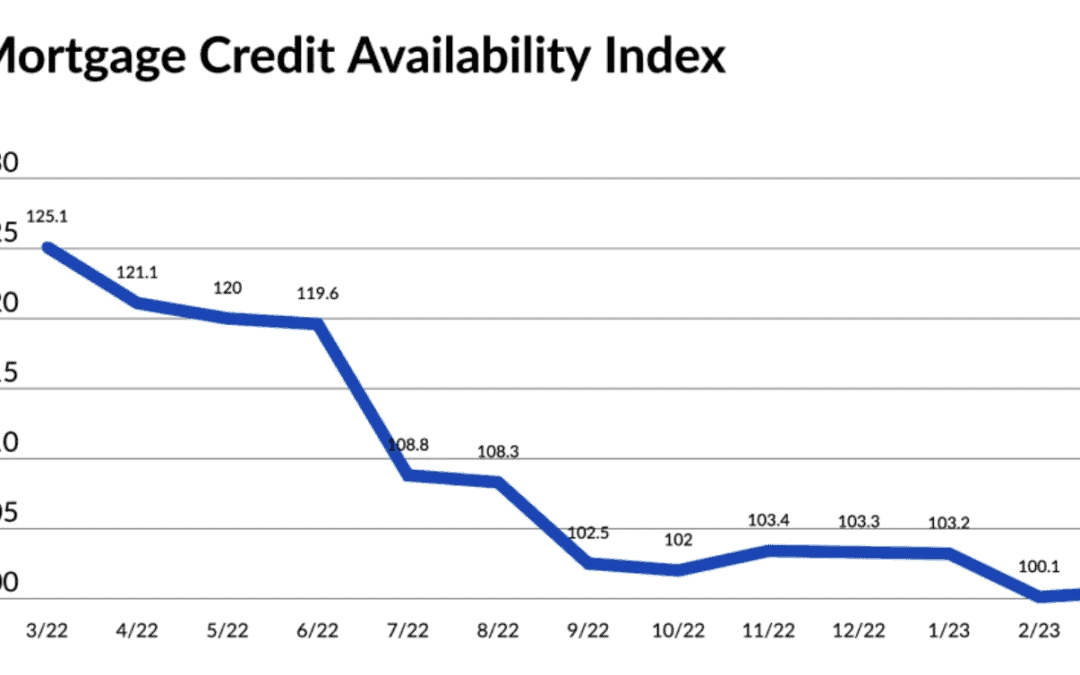

The Mortgage Credit Availability Index, an MBA analysis of loan products on offer based on data from ICE Mortgage Technology, inched up to a reading of 100.5 in March, still near its 10-year low of 100.1 reported a month earlier. The index was benchmarked to 100 in March 2012, reflecting conditions in the aftermath of the Great Recession.

Credit availability has shrunk by almost 20% year-over-year from a score of 125.1 in March 2022.

Submit a comment

Here goes your text … Select any part of your text to access the formatting toolbar.

Latest Post

12/28/2023

The housing sector is coming out of the doldrums. But will it keep improving through 2024?

Originally published on Marketplace.org by Justin Ho We’re getting a lot of housing market data this week. Yesterday, we learned that housing…

12/27/2023

First American: Falling Mortgage Rates Have Boosted Homebuying Power

Originally Published on mortgageorb.com by Erin O’Connor Home sales will reach a seasonally adjusted annualized rate of 4 million in…

07/12/2023

Amazingly, 2023 Is Not the Most Unaffordable It’s Ever Been To Buy a Home—Not Even Close

Yes, we’ve all heard it. Buying a home today might seem like the most unaffordable, and therefore impossible, it’s ever…