Millennials Remain Fundamental Drivers of Homeownership

Ryan Danko | July 2, 2023 | Housing Market | 0 comments

Amid an ever-evolving housing market over the past few years, National Homeownership Month presents an opportunity to examine a fundamental driver of homeownership and housing demand—demographics.

In fact, a new study from First American revealed there’s one generation in particular that will remain a driving force of homeownership demand for years to come—millennials.

Millennials are the largest generation in U.S. history, and in 2022, the oldest millennial turned 41 years old and the youngest was 26 years old. Funny enough, a common misnomer regarding the millennial generation once was that they were destined to be a generation of renters, although new data shows that some 51% are current homeowners.

Despite this popular opinion, millennials are not only interested in homeownership but, as of 2022, the majority of millennials—an estimated 51%—are homeowners, according to Census Bureau data.

The bulk of the millennials are over the age of 33, nearly half are married and approximately 40% have a bachelor’s degree or higher, making millennials the most educated generation in American history.

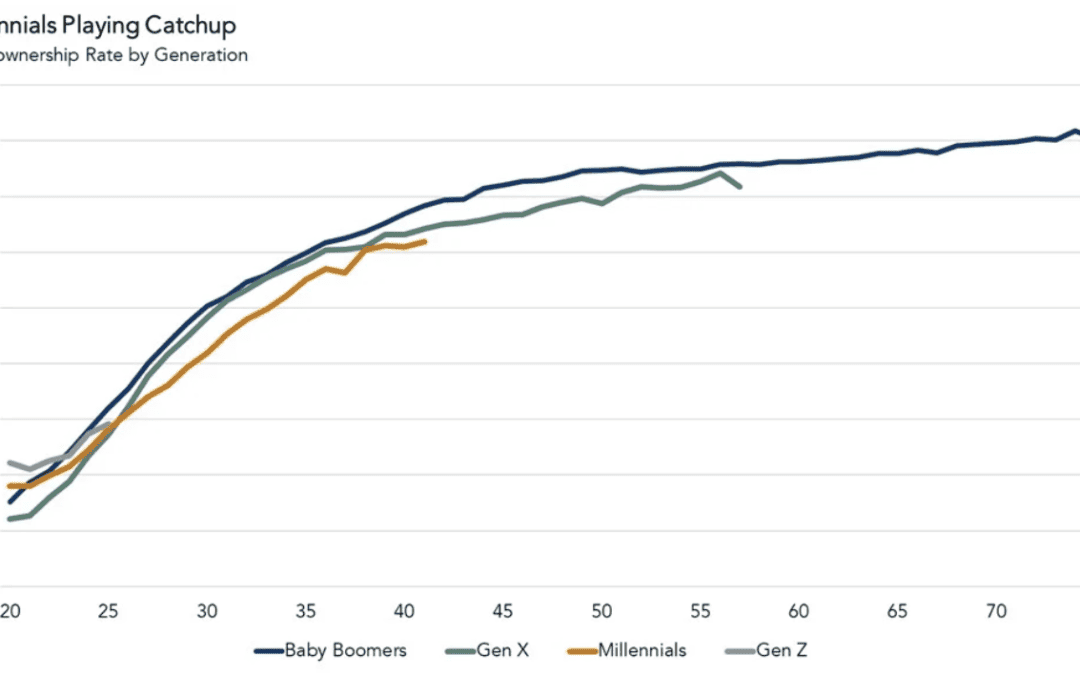

In prioritizing their education, millennials have delayed marriage and family formation relative to previous generations. The delay of these key lifestyle decisions, which are correlated with the transition to homeownership, has translated into a delay in the homeownership rate for millennials compared with their generational predecessors.

At age 30, roughly 42% of millennials owned homes, compared with 48% of Gen Xers at the same age. Over the past decade, however, millennials have significantly narrowed this gap. At age 41, the millennial homeownership rate is 62%, while Gen X stood at 64%.

Millennials’ investment in education is paying off. Higher educational attainment increases earning potential, which in turn boosts homebuying power and increases the likelihood of purchasing a home.

Millennials’ pursuit of higher education may have delayed their transition to homeownership, but it gives them a boost now that many are finally making that transition. In 2022, a third of primary home purchases were by people age 25 to 34, which includes mostly millennials, along with older Gen Zers.

Headwinds and Tailwinds

Millennials still face headwinds in the housing market, ones that have only been amplified by the pandemic. Historically low mortgage rates at the start of the pandemic, combined with a shortage of homes for sale, fueled bidding wars and pushed house price appreciation to double-digits.

Then, mortgage rates jumped up nearly four percentage points in a single year, causing affordability to fall, and pricing out many potential first-time home buyers as a result.

Despite these headwinds, millennials will remain the driving force behind homeownership demand for years to come. Their preferences around location, housing amenities, the home-buying experience and more will continue to shape the housing market. The question posed is, are millennials destined to be a generation of renters? The data suggests a resounding no.

To read the full report, including more data, charts, and methodology, click here.

Submit a comment

Here goes your text … Select any part of your text to access the formatting toolbar.

Latest Post

12/28/2023

The housing sector is coming out of the doldrums. But will it keep improving through 2024?

Originally published on Marketplace.org by Justin Ho We’re getting a lot of housing market data this week. Yesterday, we learned that housing…

12/27/2023

First American: Falling Mortgage Rates Have Boosted Homebuying Power

Originally Published on mortgageorb.com by Erin O’Connor Home sales will reach a seasonally adjusted annualized rate of 4 million in…

07/12/2023

Amazingly, 2023 Is Not the Most Unaffordable It’s Ever Been To Buy a Home—Not Even Close

Yes, we’ve all heard it. Buying a home today might seem like the most unaffordable, and therefore impossible, it’s ever…