First American: Falling Mortgage Rates Have Boosted Homebuying Power

Ryan Danko | December 27, 2023 | Housing Market, Mortgages | 0 comments

Originally Published on mortgageorb.com by Erin O’Connor

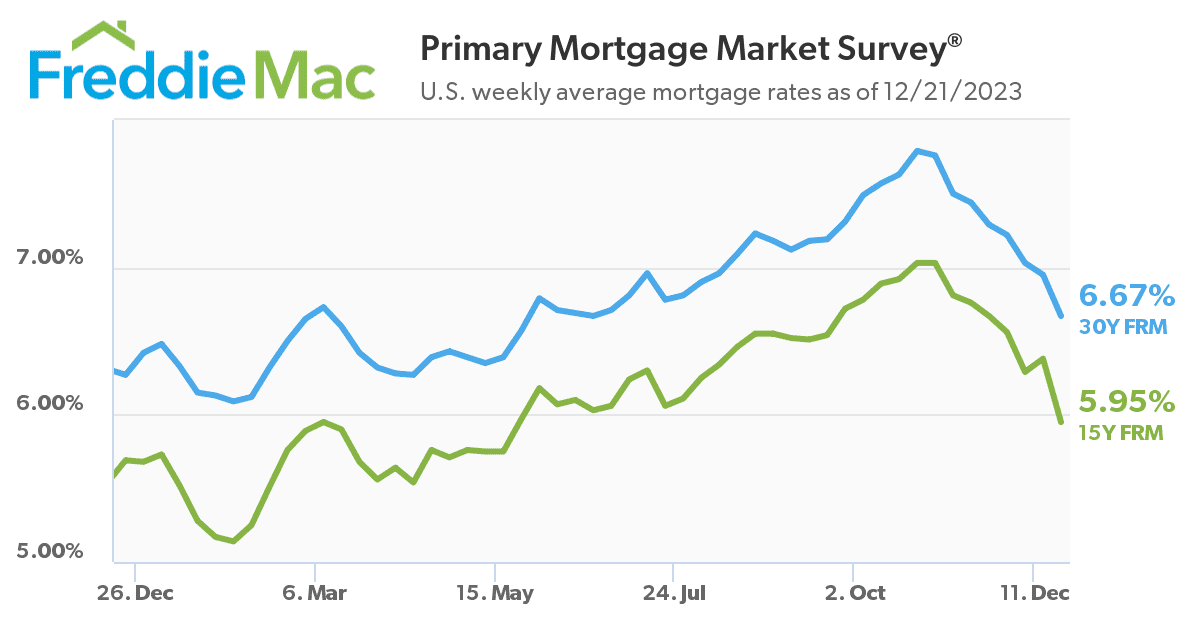

Home sales will reach a seasonally adjusted annualized rate of 4 million in 2023, thanks to falling mortgage rates in the fourth quarter, First American’s Mark Fleming forecasts in the firm’s most recent Potential Home Sales Model.

“Existing-home sales of 4 million SAAR is still low from a historical perspective, but it represents a move in the right direction,” Fleming says in the report. “Heading into 2024, existing-home sales may continue to drift higher if mortgage rates fall further or stabilize.”

Fleming points out that purchase applications increased 5% in November compared with October, according to data from the Mortgage Bankers Association, and “data from the first two weeks of December indicates a nearly 8 percent increase from November.”

“A simple analysis based on the historical relationship between mortgage applications and existing-home sales indicates that home sales should accelerate,” Fleming says.

“The road back to a market that is not too hot, not too cold, but just right will be a slow one, but recent mortgage applications data indicates a thaw in the housing market is upon us,” he adds.

However, “it’s unlikely that existing-home sales will increase dramatically,” in 2024, “as the bulk of existing homeowners will remain rate locked-in,” Fleming says.

Even if mortgage rates fall to 6%, it still won’t be enough to cause a deluge of buyers.

But as Fleming notes, mortgage rates aren’t the only factor in predicting future home sales:

“Mortgage rates combined with a 0.3 percent increase in median household income fueled a 2 percent ($6,500) month-over-month increase in house-buying power” in November, he says.

Submit a comment

Here goes your text … Select any part of your text to access the formatting toolbar.

Latest Post

12/28/2023

The housing sector is coming out of the doldrums. But will it keep improving through 2024?

Originally published on Marketplace.org by Justin Ho We’re getting a lot of housing market data this week. Yesterday, we learned that housing…

12/27/2023

First American: Falling Mortgage Rates Have Boosted Homebuying Power

Originally Published on mortgageorb.com by Erin O’Connor Home sales will reach a seasonally adjusted annualized rate of 4 million in…

02/11/2026

Awareness is only a starting point in the fight against real estate wire fraud in 2026

It’s time to revisit an important topic in this space. While we haven’t addressed real estate scams since restarting our…

12/23/2025

We’re thankful for the protection of title insurance

December offers a fitting opportunity to reflect on gratitude. Emerald Glen Title Agency appreciates the chance to be your title and…

10/06/2025

We can handle your FSBO deals, but should you go that route?

Emerald Glen Title is pleased to relaunch our efforts in this space during a milestone year, our 20th anniversary. 2025…